Welcome to Black Sheep, a spin-off publication of my serialized memoir. SMIRK. While SMIRK was a deep dive into my unusual personal and professional relationship with one unique white-collar fraudster— Martin Shkreli — Black Sheep takes a broader view and tells the stories of a wider range of business crimes and disasters (or possible impending disasters).

If you’re looking for SMIRK, you can find the full table of contents and links to all the posts in chronological order here. Paid subscribers can access all the posts; free subscribers can access select posts. Thanks for reading!

You have to hand it to Eric Adams.

Nothing can sink his spirits — not staring down the barrel of bribery charges and prison time in 2024, not the indignity of begging Donald Trump to call off the Justice Department, and not being an object of derision for 8 million New Yorkers, including most who initially voted for him. He cheerfully served as mayor, right to the end of his term, despite a widespread perception that he betrayed the public trust in exchange for hotel stays and cheap airfare.

“How long until he flees the country?” a friend asked me after he left office on Jan. 1, 2026. “Immediately,” I replied. “Or as soon as he figures out where we don’t have an extradition treaty.”

But we were wrong. Adams stayed, both in the United States and involved in questionable dealings. Within two weeks of walking out of Gracie Mansion, he publicly announced a crypto venture, the “NYC Token,” intended to “combat antisemitism and anti-Americanism.” It soared within hours of launch to a $580 million market cap before plummeting as much as 80 percent. Amid the surge, a wallet tied to the token’s deployer withdrew $2.5 million, then returned a portion of the funds, according to blockchain analytics firms. In other words, the series of events resembled what crypto people call a “rug pull.”

Basically, it’s deja vu. Once again, Adams is being accused of something that, on its face, sounds comically illegal. Before, it was allegedly trading favors for freebies with the government of Turkey while serving as America’s most visible municipal public servant. Now, Adams is under renewed scrutiny over theories that he ran a version of one of the oldest investment scams in the book, the crypto equivalent of a “pump and dump.”

A sampling of recent headlines paints the narrative:

Eric Adams’ next act is exactly what you thought it might be (Jan. 12, 2026; Politico)

Former ‘bitcoin mayor’ Eric Adams faces $3 million rugpull allegation after issuing NYC Token (Jan. 13, 2026; Coin Desk)

Investors cry foul over former NYC Mayor Eric Adams’s crypto launch: ‘Such an obvious rug’ (Jan. 13, 2026; Fortune)

Crypto coin firm touted by Eric Adams denies allegations of ‘rug pull’ scam (Jan. 13, 2026; The Guardian)

Inside the botched launch of ex-NYC Mayor Eric Adams’ new crypto token (Jan. 15, 2026; Associated Press)

The Eric Adams Crypto Scandal Is Getting Messier (Jan. 16, 2026; New York Magazine)

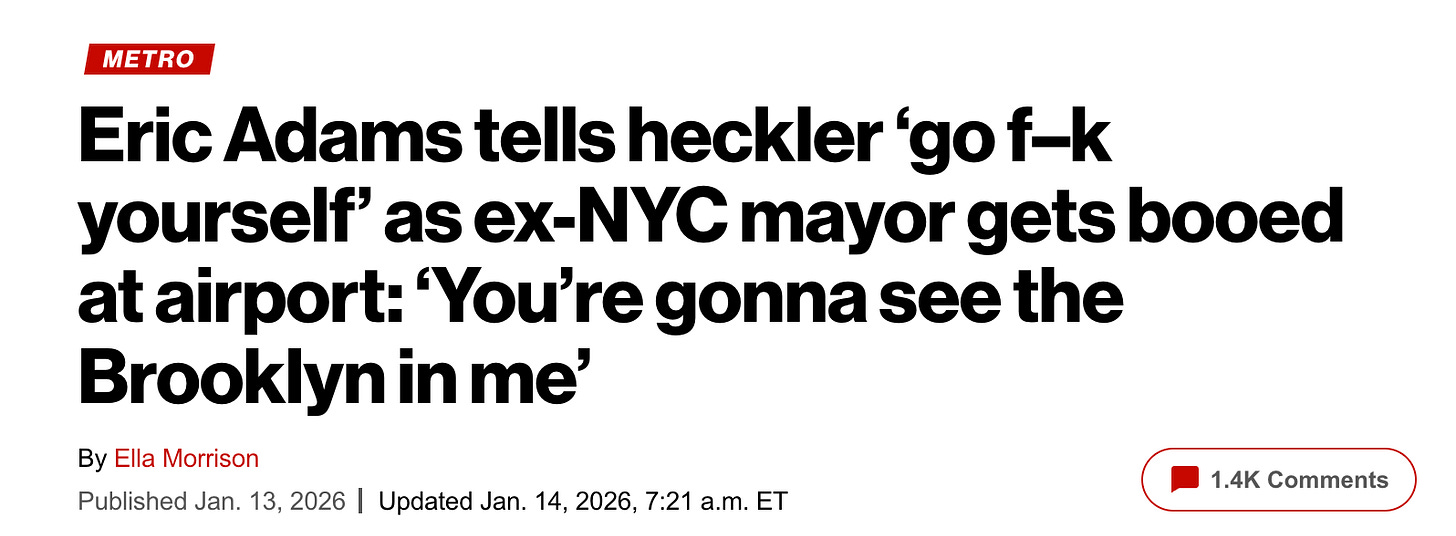

As scrutiny increased, Adams has characteristically kept moving forward, unruffled, denying wrongdoing and, according to this New York Post article, getting fairly spicy with hecklers.

Along with thrusting Adams back into an unflattering spotlight, the incident has drawn renewed attention to crypto, including claims of rampant scams and regulatory attempts to rein them in. While it was essentially impossible to avoid crypto conversations just a few years ago (remember the fever dream of NFTs, for instance?), the whole roughly $3 trillion market has hummed along in the background as the topic of AI took over tech bro podcasts, online debates, and the business news cycle.

But in the meantime, things have been happening in that space, nonetheless, which may have relevance to Adams:

The SEC became noticeably friendlier to crypto

For much of the early 2020s, the SEC’s crypto policy was defined mostly by bringing sweeping enforcement actions based on the presumption that crypto offerings were almost always “unregistered securities,” and therefore violating securities laws. Under former Chair Gary Gensler, the agency filed cases against Coinbase, Binance, and Kraken, using a Supreme Court precedent from 1946. Despite the crypto industry's outcry for modernized regulations, the lawsuits kept coming, leaving companies in a constant state of uncertainty.

That posture has changed. Since 2025, the SEC has dropped or narrowed several high-profile enforcement cases and shifted its public messaging toward classification and guidance rather than blanket suspicion.

Meme coins have especially become less legally risky

Meme coins, so-called because they get hyped up or spread as jokes on social media, were previously often a target of regulatory concerns, for obvious reasons. However, in 2025, the SEC’s Division of Corporation Finance issued guidance that more or less gave them the green light by specifying that most do NOT qualify as securities. The guidance now treats tokens that lack profit-sharing rights, governance claims, or promises tied to managerial efforts as speculative collectibles, not as investment contracts, offering much wider latitude.

The Trump administration launched its own meme coin

Along with ushering in a new attitude on crypto enforcement, the Trump administration launched its own meme coin: $TRUMP, followed closely by a $MELANIA token. The Solana-based coins, issued days before Trump’s second inauguration in January 2025, surged in value to tens of billions of dollars before collapsing sharply and shedding most of their gains. Analysts estimated the project generated hundreds of millions of dollars for Trump-affiliated holders. While there was outcry over perceived ethics and legal violations, no substantive regulatory actions were taken.

Pardoning crypto fraudsters

As part of the about-face, Trump also provided clemency to crypto criminal defendants. Most notably, Binance founder Changpeng Zhao, or “CZ,” was pardoned in October 2025 after pleading guilty in 2023 to a felony for failing to maintain an effective anti-money-laundering program. The guilty plea was part of a broader $4.3 billion settlement between Binance and the US, under the Biden administration.

Fulfilling a promise to vocal libertarian supporters, Trump also pardoned Ross Ulbricht in January 2025, saving him from the multiple life sentences he had been serving since 2015 for operating the Silk Road, a marketplace that facilitated the sale of illegal goods and services using Bitcoin. While more of a political reward, the pardon also signaled a distinct shift away from the government portraying digital assets as a boogeyman synonymous with criminality.

Crypto has become less “fringe,” more mainstream

All the while, crypto has continued its migration into the financial establishment. Major banks can now be used to hold digital assets. Stablecoins operate under federal law. Bitcoin and Ether ETFs trade in portfolios alongside traditional securities. For better or worse, the crypto bros finally got the institutional acceptance they had been craving while, ironically, rebelling against institutions.

Impact for Adams

To Adams, or anyone else in similar circumstances, all these developments might signal a more permissive culture regarding crypto. But here’s the thing: fraud is still fraud.

Largely indifferent to the Trump administration’s posture, Democrat-driven state and local prosecutors have continued to pursue crypto fraud using consumer protection, money laundering, or other laws at their disposal. New York Attorney General Letitia James continues to freeze crypto assets tied to scam rings, sue firms accused of misleading investors, and secure settlements. Similarly, California Attorney General Rob Bonta has shut down dozens of fraudulent crypto websites accused of luring victims into investment scams.

Separate categories of crime that happen to involve crypto deals or crypto-related figures also remain fair game for US attorneys’ offices, such as a Brooklyn sanctions-evasion case and an Illinois money laundering case. While cases specifically citing “rug pulls” dropped off over the past couple of years, multiple defendants were sentenced to prison in 2025 in federal cases over crypto-related investment scams (examples here, here, and here).

All this has obvious implications for Adams, whose ongoing legal exposure from multiple angles remains an open question. Even after the Justice Department dropped its corruption case against him, probes focusing on his inner circle have continued.

Just this month, the federal probe was rekindled with the indictment of Adams’ City Hall liaison to public housing residents, who was accused of taking bribes in exchange for giving unfair business advantages. Although the feds are barred from rehashing the Turkey-related bribery charges against Adams, nothing stops them from bringing new charges over other alleged misconduct if the evidence supports them. The latest indictment shows interest in that area is still alive and well.

Now that he’s out of office, Adams has no more influence to trade and no “get out of jail free” card close at hand. With his crypto venture, he has handed investigators a whole new book of material to work with. We’ll see if he keeps his cheerful smile.

For more on the previous Adams’ case, see my earlier Black Sheep post here.