Welcome to Black Sheep, a spin-off publication of my serialized memoir. SMIRK. While SMIRK was a deep dive into my unusual personal and professional relationship with one unique white-collar fraudster— Martin Shkreli — Black Sheep takes a broader view and tells the stories of a wider range of business crimes and disasters (or possible impending disasters, as is the case here).

If you’re looking for SMIRK, you can find the full table of contents and links to all the posts in chronological order here. Paid subscribers can access all the posts; free subscribers can access select posts. Thanks for reading!

As 2026 gets underway, AI remains the economy’s North Star. We still do not know whether it will lead us to a brave new world or off the edge of the map, into the jaws of sea monsters. But one visual signal has served to calm fears, bolstering faith that no matter what hype may be overinflating the market now, everything will turn out fine in the end: Jensen Huang and his leather jacket.

Bear in mind, this is pattern recognition more than rigorous analysis; I'm reading the vibes, not building valuation models. But markets move on confidence as much as fundamentals, and sometimes the symbols we cling to reveal more about where we’re heading than the spreadsheets do.

You see, while investors remain mostly steadfast in their grandiose visions of the future, and in their commitments to a vast AI infrastructure build-out, the voices of critics have steadily grown louder, sharper, and more sophisticated. Fields Medal recipient Terence Tao, for instance, has pointed out weaknesses in large language models, noting that they are “probabilistic” rather than “grounded” in reasoning, and can easily make mistakes that “go off the rails.” Meanwhile, trader Michael Burry of The Big Short fame has raised doubts about the financial assumptions underpinning the boom, placing a contrarian bet against AI in late 2025.

These doubts touch nerves because so much of the AI boom, and by extension so much of the broader economy, rests on future promises, optimistic projections, and business models that are still searching for profitability. Yet through all the bluster, noise, and increasingly unsettling questions, investors have largely stayed the course, reassured on some psychic level by Huang.

If you are not familiar with him beyond a vague flicker of recognition as a “tech guy in a leather jacket,” it is worth establishing who we are talking about. Jensen Huang is the co-founder and CEO of Nvidia, a specialized computer chip maker whose products were once used most notably in video gaming and are now indispensable to AI. Since ChatGPT introduced most of us to generative AI in 2022, Nvidia’s trajectory has been nothing short of astonishing. In three years, annual revenue surged from roughly $27 billion to well over $130 billion, and the company’s market capitalization ballooned into the trillions, at times surpassing even Apple, Microsoft, and other tech behemoths.

Huang himself is also a remarkable success story. Born in Taiwan, raised in Thailand, and educated in Kentucky, Oregon, and at Stanford, he brings a global perspective paired with the bold sensibility of an American industrialist. Far from being a green newcomer to tech, Huang is in his early 60s, having launched Nvidia in the 1990s while hanging out at a Denny’s restaurant. He is battle-tested, having shepherded the company through multiple economic cycles, including a near-bankruptcy after the dot-com bubble burst.

On top of all that, and here is where my theory comes back into view, Huang really does have a thing for wearing leather jackets. As the AI bubble surged, he has been seen wearing them everywhere: in the business press, at tech symposiums, on industry podcasts, the Joe Rogan Experience, and in numerous selfies with fans on social media (see below).

Amid the exponentially intensifying spotlight, it is hard to fault Huang’s choice of fashion armor. Leather jackets have been cool since the days of James Dean, projecting an unflappable confidence with a hint of youthful rebellion. Perhaps that is why Huang, an outlier in Silicon Valley’s cult of youthful hotshots at the cutting edge of innovation, first defaulted to the jacket, as a way to seem young and hip.

But something more powerful, and more concerning, has begun to happen as Nvidia has become increasingly aligned with the fate of AI itself. Investors have started to put weight in the jacket as a symbol, a stand-in for operational competence amid a swirl of uncertainty, and a visual confirmation that someone grown up has a firm grip on the controls.

To be sure, other tech giants have recently provided their own steadying signals. Google's Gemini advances and search integration, for instance, have reminded investors that the AI ecosystem extends beyond any single chipmaker. But none have offered quite the same visceral reassurance as Huang in his jacket.

As one trader joked recently on social media (below), the market seemed to be waiting once again for “one man and his leather jacket” to save it.

Meanwhile, a Wired journalist noted the shift from “leather jacket” to “shiny crocskin,” asking pointedly, “Bubble indicator?”

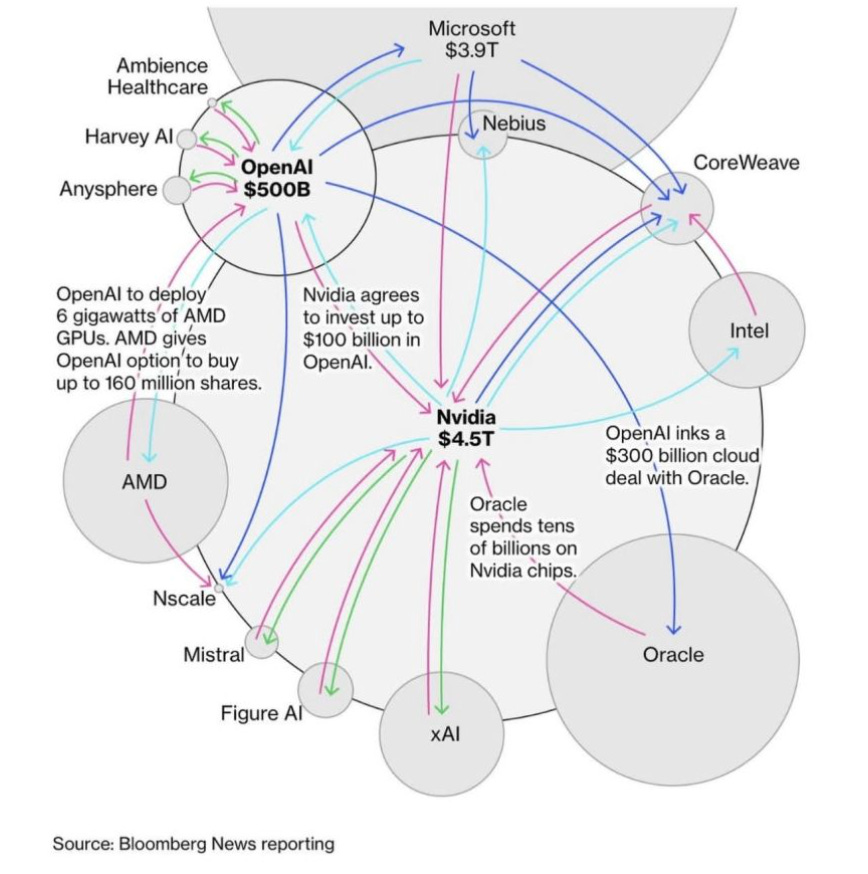

Cheeky though these remarks may be, they carry a kernel of truth. As the AI boom swelled, Nvidia became increasingly enmeshed in it, not only providing chips but also financing the purchase of more of them. A Bloomberg graphic illustrating the round-trip nature of these transactions went viral last year, raising more than a few eyebrows.

One starts to wonder whether Huang’s optimism, conveyed symbolically by the jacket, has become one of the main forces holding the ecosystem together. How much of the S&P 500 is currently propped up by appearances of Huang in his leather jacket? The effect is impossible to measure, but it is probably larger than many would like to admit.

Huang has not only kept showing up in leather jackets, he has also continued to issue market-stimulating predictions and soundbites, often based on little more than his own confidence. Among them:

“In 2-3 years, 90% of the world’s knowledge will be generated by AI.” [podcast excerpt]

“Intelligence is about to be a commodity.” [speech to the UK’s Cambridge Union]

“It's very likely that human robots are going to be robots that we can deploy into the world relatively easily..and I think this is likely to be the next multi trillion dollar industry." [Bloomberg TV interview]

“I’m improving the performance by a factor of 10 times each year, but demand is going up by a factor of 10,000, a million times each year.” [CSIS fireside chat]

In about 10 years, the computational capabilities of AI systems will be a million times bigger than they are today. [paraphrase, Stanford SIEPR Economic Summit]

“AI will create more millionaires in 5 years than the internet did in 20… I’ve created more billionaires on my management team than any other CEO in the world.” [All-In podcast]

“The AIs are smart enough that everybody wants to use it, and we now have two exponentials happening at the same time — models needing exponentially more computing power and exponential demand growth for their use.” [CNBC’s “Squawk Box”]

Unsurprisingly, this kind of commentary has not only helped support stock prices, it has also seeded think pieces, LinkedIn posts, and tech articles, creating a cultish feedback loop that drowns out critics, at least temporarily. Having noticed this phenomenon, I find it profoundly unsettling. No matter how much talent, vision, and discipline Jensen Huang brings to the table, he cannot hold a bubble together all by himself, even if it sometimes appears he is trying to do exactly that.

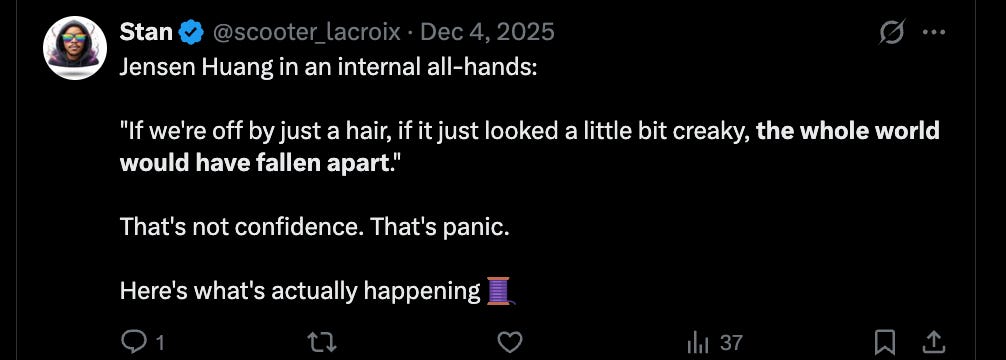

In a rare flash of candor, Huang has acknowledged his own anxieties about Nvidia’s importance to the broader economy. According to Business Insider, he told employees at a recent all-hands meeting that “the whole world would’ve fallen apart” if Nvidia missed earnings expectations, adding that “we’re basically holding the planet together.”

The full quote is striking:

If we delivered a bad quarter, if we're off by just a hair, if it just looked a little bit creaky, the whole world would've fallen apart. There's no question about that, OK? You should've seen some of the memes that are on the internet. Have you guys seen some of them? We're basically holding the planet together — and it's not untrue.

The comments escaped widespread public attention, but a few observers who noticed them found them alarming. One poster on X summed it up bluntly: “That’s not confidence. That’s panic.”

Huang, as an experienced CEO, undoubtedly senses the hazards ahead, and like the captain of a ship bound for uncharted seas, is doing his best to lift collective spirits. The jacket plays an implicit role, much like a sea captain’s uniform. But uniforms cannot calm the sea, and confidence alone cannot resolve the structural questions investors have chosen, for now, to ignore. A moment may lie ahead when even that confidence falters, and if it does, there will likely be visual tells.

As the year unfolds and we see what it brings for the economy and for AI, it is worth keeping an eye on Jensen Huang. Want to know whether trouble is around the corner? See if he keeps wearing the leather jacket.

CORRECTION: Earlier, I misstated Nvidia’s revenue in 2022. Here are the company’s revenue figures from 2020 - 2025, and you can refer to the company’s earnings releases (linked) for confirmation:

2020: $11 billion

2021: $17 billion

2022: $27 billion

2023: $27 billion

2024: $61 billion

2025: $130 billion