Hello everyone,

This is some bonus material for paying SMIRK describers in which I provide some additional background and commentary on recent installments of the memoir. In particular, this segment focuses on last week’s posts, “Hedge fund hustler” and “What’s in a scam?” .

A transcript of today’s commentary is also provided below:

(NOTE: THE FOLLOWING IS A TRANSCRIPT OF AUDIO NOTES. IT IS NOT A COMPOSED PIECE OF WRITING, AND THERE ARE A LOT OF “UM’S,” AND “LIKES,” AND “YOU KNOWS,” ETC.)

”…I think the issue of hustling and fraud are interesting issues that deserve to be poked at a little bit. When you see stories about fraud in the media, or if you've ever watched a fraud trial (I have seen several trials from start to finish, like big securities fraud trials), there's kind of this defecting to a hard bitten language that is very evocative, and it sort of sounds like something that comes out of the 40s.

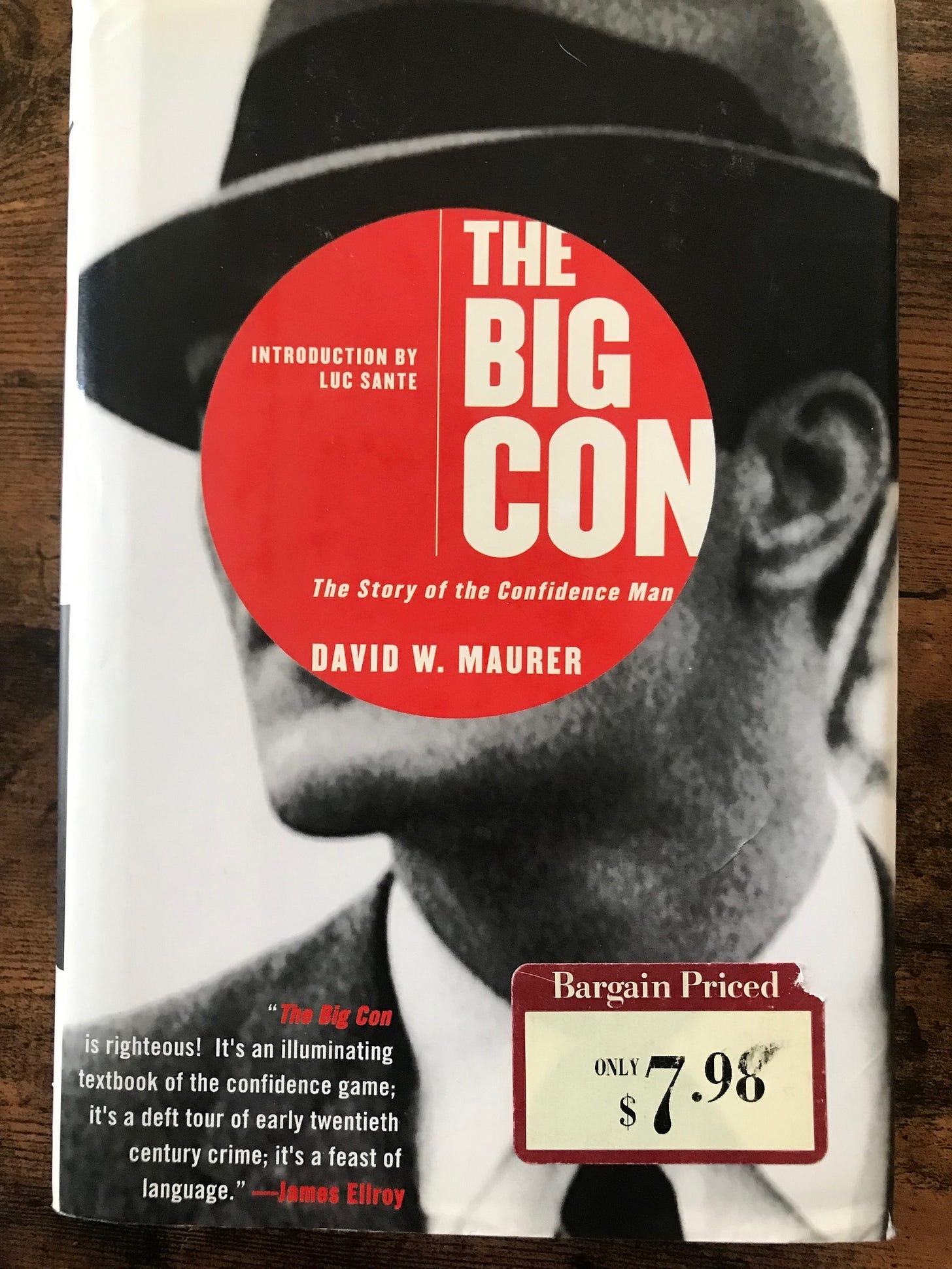

And that makes sense. Because, you know, a lot of this language harkens back to the “The Big Con,” by David Maurer which was sort of a canonical work on scam artists and cons and the kind of fraud that we go to in our minds, when we hear words, like, “he defrauded someone.” You think of someone conning as someone looking for a mark, and trying to part that mark from their money through some kind of deception.

So we use words, “scam artist,” “grifter,” all this stuff sounds like it comes out of a 40s movie. Because that's how powerful “The Big Con” was, in terms of having that staying power in all of our minds in our culture.

Those kinds of scams definitely happen all the time. And it probably always happened as long as humankind has been on this planet. We've always come up with ways to lie, to try to get what we want, right? You know, we're human beings. We have complex minds, we're creative, or imaginative, we will look for an easy way to do things if it's possible.

Even in the animal kingdom, if you're looking, aside from from primates, even, you can find animals, like certain kinds of birds, and other intelligent species that will misrepresent themselves.

But anyway, so backing up to scams and fraud and cons — when you if you watch a trial from start to finish, or if you've watched several securities fraud trials, like I have, the prosecutors all sound like they're sort of plagiarizing each other in certain parts. They get to some part where they talk about greed, and then they get to some part where they they start invoking this language that we're all used to, these kinds of label for all kinds of fraud.

And when you hear it over and over again, you know, your eyes roll, because you're like, “they can't all be like that.” And they're not usually. Yes, there are plenty of traditional scams and scam artistry that happens all the time. But a lot of things that get prosecuted as fraud are actually quite a bit more complicated. And it's more complicated than just greed in terms of the motivations.

So it kind of feels like we're all used to shoehorning fraud into a certain picture that doesn't always fit. So where I'm going with this is, okay, so for instance, as an example: insider trading is prosecuted as securities fraud. It's considered a fraud on the market and on the public. Because, you know, certain people are getting tips and trading information with each other, that is not available to the public about public companies.

But I think most of us would not lump insider trading together with Ponzi schemes and Madoff, even though they're all technically fraud. Because we know that, you know, when someone's like giving like someone an edge or a tip, that that's not really like directly stealing from anyone. There are some people out there who would argue that insider trading is actually a victimless crime. I'm not sure if I agree with that, but that's what some people might say.

And you know, they have something to stand on with that, which is that, you know, the only victim is the market generically. It's not the same as stealing from someone. And I think the public kind of gets that.

There's also the kinds of fraud that are by omission more than by outright stealing, or like outright deception. You know, this gets to be an issue with public companies if, say, you have some side arrangement with a friend, or some sort of dealings with like a vendor who is maybe a friend of yours, or a relative and that isn't reported and made available to the public, that’s an omission that could count as fraud. Even if you don't have the intention of stealing from anyone or doing anything bad. Just the failure to provide that information could technically be a crime if it's a public company.

My favorite kind of scam, obviously, if you want to call it a scam, is the “fake it ‘till you make it fraud,” which is the one that we see so many millennial hustlers doing. The big ones in the headlines, you know, including Elizabeth Holmes, from Theranos, and Billy McFarland, and Anna Delvey. And of course, Martin Shkreli.

These are all these frauds where people are, you know, their eyes are bigger than their stomachs in a sense, and they're really trying to do stuff and be something. And they're cutting corners along the way, and they're lying about how things are going, but they're not intending to actually steal from people. I think that that is a big distinction between the “fake it ‘till you make it fraud and like “The Big Con” kind of fraud.

If you are going into a situation, creating a lie, just so that you can take some money from somebody and run off, that's a con, that's a scam. But if you are lying because you are trying to cover up for earlier lies that you told in the process of trying to build a company and keep your investors happy, and you've got a goal in mind that isn't, you know, related to fraud or theft, it’s different.

And it's not just greed, there's ambition woven in there. And sometimes that ambition is clouding people's judgment. So as I mentioned, I think in the last SMIRK post, that's really, I mean, that's the kind of fraud that Martin did when he started his hedge funds. You know, he grew up in a, I wouldn't say poor, but definitely working class family. His parents were Albanian immigrants. He slept on the floor in a two bedroom apartment, with, you know, siblings in the same room.

This is a person who kind of basically has nothing. And when you go from that, to like, high finance, there's, you know, it's it, there's a very huge disparity there. And you are competing in a world where some people, you know, their parents are super wealthy, and, you know, if they, you know, super wealthy parents have like a son or a daughter who wants to get into investing, they might just give them like, “Oh, here's $10 million of the family money, you can manage and see what you can do with it.”

And trading is hard, you know, like, the people who actually do the trades, and put their that risk on the line, they're always a little bit crazy, because there's a lot of pressure that comes in that. You have to learn a lot about yourself along with the market, and various companies in order to be a good trader. And, and obviously, when people are young and are inexperienced, they're, they're liable to, you know, fall victim to their own impulses, to take big risks that they shouldn't take. And just not to understand situations as well as when a person has kind of been around for a bit has had some failures to their name and has learned some things.

So Martin starting out young, no money, very smart, you know, is kind of like hustling his way into various parts of society and rubbing elbows with as many people with big names as he can. You know, and he's trying to persuade people to let him manage their money. And so, yeah, he lied in the process of doing that. There was a rich guy named Josiah Austin, worth around $300 million, at least a few years ago, who, who liked Martin and thought he was very smart, and wanted to give him a chance.

Martin saw an opportunity there, clearly and, you know, tried to cozy up as much as he could to Josiah Austin and be as helpful as he could, by doing all this research for him kind of on spec and making all these calls on pharmaceutical investments. And in a sense, he was kind of casually serving as as sort of a pharmaceutical investment advisor to to Josiah Austin. But the arrangement was never really formalized. It was just, you know, Martin being a hustler, and trying to provide value to this man, who did listen to a lot of Martin's advice.

But it’s one thing to kind of have sort of a casual relationship. I know that it's another thing to say, “Oh, yeah, I was managing $40 million in investments for this man.” I mean, that's not really accurate. So but when Martin started, you know, launching his hedge fund, his next hedge fund after the first hedge fund Elea Capital, where he basically was just managing a chunk of Josiah Austen's money…when Martin went to start his other hedge funds, MSMB and MSMB Healthcare, he kind of led people to believe and told them, you know, he had been managing, he was managing $40 million in assets, which wasn't true.

There were lots of other little lies that sort of leaked out in various places. You know, he said, I think he told some people he went to Columbia. He didn't, he went to Baruch. I think maybe he took some, like, extracurricular classes or something at Columbia, but he definitely went to Baruch. He let people think he was bigger than what he was, because he wanted them to feel like they could trust him. And he wanted to get their money to manage, not to steal from them, but he wanted to be able to manage their money. Still fraud, still not good.

And he did do unfortunately, more or less the same thing that happened at Elea. He took some risky bets, there were, you know, good days and bad days and good calls and bad calls. But he took some, you know, took some heavy risks with a short sale, where you're betting that the stock of a company will fall. And he borrowed on a credit line on a margin account, to sort of in hopes of increasing the return exponentially if he was right. But what happens if you're wrong? If you're you, you know, or you could be out a huge amount on that credit line. And he ended up way underwater MSMB was completely wiped out.

I think he owed as much as $10 million at first to Merrill Lynch, and then he had some assets, and then it was like $7 million. And then, because MSM be essentially, you know, went bankrupt, he was able to negotiate that amount down to I think, $1.5 million.

So, fundamentally speaking, after his second failure, a second big failure, Martin, you know, could have walked away all of the things that he had done. He might have gotten him in trouble. But, you know, those were kind of small potatoes and not hugely interesting to prosecutors and regulators.

Anyway, after the blown up hedge fund, Martin could have walked away, probably without any real consequences. But he didn't do that. And what I found really strangely miraculous and what kind of changed the narrative for me was learning what he did and how he went about what came next. You know, he's wiped out. One of his employees testified to walking into this, you know, closet sized office that they shared and seeing him like, the lights aren't on and like, he's like hiding in his hoodie and clearly destroyed.

And instead of just staying destroyed, he, he thinks about it, and he realizes that he could probably start a pharmaceutical firm, it's a wild idea would never work for most people. But, you know, he puts together a plan, he kind of gets some investor support. And he starts Retrophin. And to think of the resilience that it took to do that, yeah, it really does kind of change things a bit for me, because this isn't just a fraudster, this is someone with dreams, and he's going to stop at nothing to try to achieve them. And, you know, to make sure that people are getting what they, they signed on for with him.

So he starts Retrophin. He’s able to actually kind of patch together a company that actually works, and take it public and, and create real value. And through that real value, he just managed to find ways to distribute some of that value to the investors he burned. And all of them with maybe one or two exceptions, ended up getting much more than what they had invested with Martin originally.

So we have this fraud, where he's, you know, he's lying to get people to invest with him, loses their money through being stupid. And then he starts a whole new company, and it actually works. And he finds a way to pay them to pay them what he owes by basically treating them as investors and consultants in this company that he started, which they kind of were. And, yeah, a lot of that is not legally kosher, obviously. I mean, he ended up prosecuted and convicted of some crimes related to all of this clearly.

But this is a long way away, this type of crime has is like a universe away from, “The Big Con,” where you like set up a shop and you persuade someone to, invest in a business that doesn't exist and will never exist, and so on, and then just walk away with, with the money and leave them holding the bag. We're all used to all these things being lumped together, especially when prosecutors and media headlines talk about them.

When you look at like the human decisions involved, it really isn't the same at all. So this brings me to kind of the latest Martin drama. You know, Martin and I haven't been dating since early 2020, really. But we’re friends and we still talk. I was aware of him doing his his crypto-backed Druglike startup. I thought it was kind of a cool idea. I was supportive of that, and doing the software company that is crypto-backed, that would allow sort of open source opportunities for the early stages of drug discovery.

So I thought that was cool, you know, why not open that kind of thing up to a wide range of chemists or anybody who's like interested in that area? Kind of lowers the barriers a little bit. But so, you know, that was going well, for a little while. But then there was this problem. Martin said that he was hacked, I believe it. It's exactly the sort of like dumb luck that the Martin tends to create for himself.

You know, by clicking a Trojan, or clicking a torrent link for a porn site. And it turning out to be malicious software embedded in it and getting a hold of his wallet and getting the proceeds of his crypto plan, which I think was something like $400,000. Because everyone is going by, you know, the word “scam” and kind of like shoehorning all those things together with what he did before, lots of people on the internet are saying, “Oh, he did a rug pull,” which is basically the crypto equivalent of a old-school con.

And it just doesn't add up to me at all. I mean, first of all, first of all, that isn't really the character of the fraud that he did before. He didn't just like try to scam people out of money and run away. He did the exact opposite of that actually.

And second of all, you know, he's trying to rebuild something of a life for himself. He still has plans on achieving success and being respected. And you don't get that way by pulling little rinky dink frauds. I mean, $400,000 is kind of a rinky dink fraud for somebody like him who used to be worth as much as $200 million. If you can't imagine Elizabeth Holmes doing it, she's not going to do something that shady, I'm sure I there's no way Martin would do that. They're, in both cases, I think they both have too much self respect.

And then you know, another thing is that the drug like thing that he came up with, he's been talking about doing that for years. He's he first talked to me about that, oh, gosh, I think probably right after he first went to prison sometime in like 2017. So this is something he cares about. It's not like just a fly-by-night idea he just came up with.

Third of all, what's persuasive to me is that Martin's really bad at hiding his emotions, he doesn't really like talking about them. But he's also like, equally bad at not showing them. He’s often been described as mercurial, and hard to deal with sometimes, because he can be unpredictable. Some people who would say he seems manic depressive, because he goes from these highs and lows.

In my experience of talking to him, and I've known him for years, several years now, when he's in a good mood, when things are going well, for him, when he is achieved some plan or some modest success, he's really in a great mood. He's super excited. And he's like a child who want a video game and he wants to talk about it. He's pretty responsive, if I like reach out to him.

Whereas when something goes very poorly, and it's sad, and he loses something, or things get increasingly difficult, he kind of withdraws, and doesn't really socialize. He's he's non responsive, usually. And he's been that way. He's been, you know, he's still talks a little bit, but he's been less responsive. So that suggests to me that he did not achieve any plan that he wanted, and that probably things have gone quite badly.

I just don't think it's really fair to just throw everything together under the stereotype of a “con” because lots and lots of business crime is not exactly like that. There are lot of situations where otherwise fundamentally good people start making bad decisions, and it just becomes kind of an endless like, you have to keep throwing more into it.

So yeah, don't, don't buy the cheap lines. Look closer than just what the headline says. Headline writers love words like “scam” and “grift” because they're short and punchy, and get you to click but like, actually pay attention to what the thing was that was done, and try to keep your emotions out of it until you understand what actually happened. That's what I would advise when you're looking at stories like this.

But thank you again for listening and for reading, and I appreciate you subscribing to SMIRK.